With an outstanding record of reliable stewardship, we provide investment options suited to your client’s philanthropic intentions across different time horizons.

- Empowering Nonprofits & Scholars

- Activating Givers

- Engaging Volunteers & Key Skills Hub

- Key Skills Hub

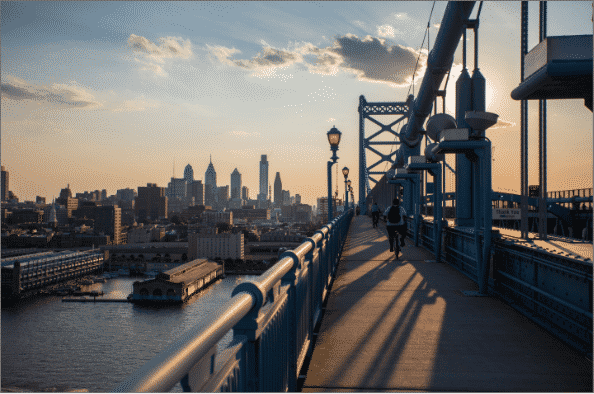

- A New Century

- All About Us

- On the Table Philly

- Givers

- Professional Advisors

- Nonprofits

- Students

- Media

- Events

- Contact

- MyDonorPortal

- Give Now